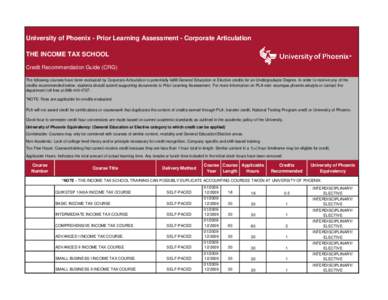

21 | Add to Reading ListSource URL: cdn.assets-phoenix.net- Date: 2016-12-30 20:10:05

|

|---|

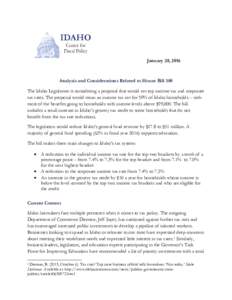

22 | Add to Reading ListSource URL: idahocfp.org- Date: 2016-01-29 11:40:10

|

|---|

23 | Add to Reading ListSource URL: www.oecd.org- Date: 2016-11-24 11:32:46

|

|---|

24 | Add to Reading ListSource URL: www.kotlikoff.net- Date: 2014-09-12 13:44:41

|

|---|

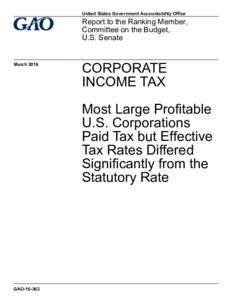

25 | Add to Reading ListSource URL: www.gao.gov- Date: 2016-04-13 09:00:49

|

|---|

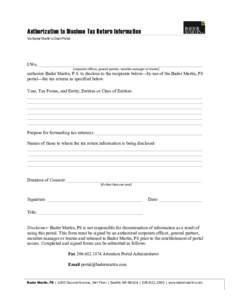

26 | Add to Reading ListSource URL: www.badermartin.com- Date: 2013-11-18 23:13:59

|

|---|

27 | Add to Reading ListSource URL: www.grantthornton.lu- Date: 2015-05-27 11:36:13

|

|---|

28 | Add to Reading ListSource URL: www.vivaafricallp.com- Date: 2016-05-27 10:44:21

|

|---|

29 | Add to Reading ListSource URL: www.homepages.ucl.ac.uk- Date: 2012-03-20 13:19:57

|

|---|

30 | Add to Reading ListSource URL: www.iafei.org- Date: 2014-10-31 00:00:04

|

|---|